If you follow its payment schedule, you’ll pay a monthly installment, plus interest, to reduce the cost of your vacation over time. It works just like a typical credit or debit card, except whatever you spend adds to your FNPL loan balance.Īfter booking your trip, Fly Now Pay Later starts charging you interest on your due date, which is usually the next month. If you accept its terms, FNPL provides a single-use virtual card to pay for your booking at checkout. You don’t need to plan for it because approval happens digitally in seconds. It typically only takes a few minutes to apply for Fly Now Pay Later. Payment plans range from two to 12 months. Depending on your credit history, FNPL will offer an APR between 9.99% and 29.99%. When you check out, FNPL asks for your financial information to do a hard credit check. Fly Now Pay Later allows you to borrow between $100 to $3,000 to cover these expenses. You can book flights, lodging, and experiences through FNPL’s directory of partners. You can book directly in the app from its directory of providers like:

#Fly now pay later affirm download

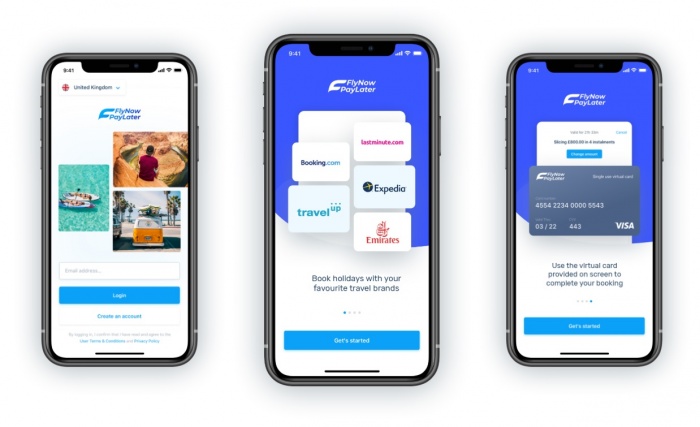

To use Fly Now Pay Later, you’ll need to download the app. Schedule last-minute trips for family emergencies Point-of-sale loans from Fly Now Pay Later charge interest that increases the loan balance over time, but this service allows travelers to spread the expenses of travel across several months. You sign up for Fly Now Pay Later, book your travel with a single-use virtual card and then pay Fly Now Pay Later through monthly installments. Launched in 2015 in the United Kingdom, Fly Now Pay Later is a type of point-of-sale loan. These options are so popular that airlines like United partner with them natively through their online booking portals.įly Now Pay Later is similar to general financing apps like Affirm, but it’s specifically for spreading out travel costs. To afford travel, some people turn to buy now pay later services like: adults worry about having enough money in their emergency fund, it isn’t always realistic to pay cash for travel. The average cost of a flight ranges from $275 to $735. In addition to explaining more about what FNPL is and how it works, we’ll take a look at Fly Now Pay Later reviews and sum up the benefits and risks of the service to help you decide if it’s the right option for you. Fly Now Pay Later (FNPL) is a popular option that allows travelers to spread out the cost of a dream vacation. But instead of forgoing travel, some people look for alternative ways to pay for their trips: affordable installment plans. Even a modest one-week vacation costs $1,163 for a couple. The daily cost for a vacation ranges from $83 to $633 per person. Although many travelers are satisfying their wanderlust, 44% of people who chose not to travel said finances had a lot to do with their decision to stay home. More people want to see the world in fact, travel spending hit a high of $105 billion in June of 2022.

0 kommentar(er)

0 kommentar(er)